Obamacare Premium Increases in 2026: What You Need to Know

This week, the latest prices for 2026 Obamacare health insurance plans have been revealed, and they indicate significant premium increases nationwide. Understanding these changes is crucial for millions of Americans who depend on these health plans.

Effects of Expiring Subsidies

While many consumers do not pay full price for their insurance thanks to tax credits provided by the Affordable Care Act (ACA), the new premium figures reflect the reality of what will happen if the enhanced subsidies—initially introduced in 2021 and extended in 2022—expire by the end of this year. If these subsidies end, numerous Americans could face monthly cost hikes exceeding $1,000.

Government Costs and Congressional Action

Extending these subsidies is estimated to cost the federal government about $23 billion in 2026 alone, summing up to around $350 billion over the next decade. The urgency around this funding issue has contributed to a prolonged governmental standstill, with Democrats advocating for the subsidy extension as vital support for a government funding bill, while Republicans have insisted such discussions can only occur post-reopening of the government.

Impact on Low-Income Earners

For those earning below $24,000 annually, the termination of subsidies translates into a loss of free, comprehensive insurance. Currently, these individuals contribute nothing toward their premiums but still incur some co-payments. After subsidies expire, someone earning $22,000 would likely pay around $66 monthly for a typical health plan.

Middle-Class Struggles

A significant portion of enrollees—nearly half nationwide—will face similar premium increases. A person earning $35,000 per year could see their monthly premium more than double, from $86 to $218 for a popular plan. Approximately 40% of enrollees earn between $24,000 and $63,000 and will experience comparable hikes in their insurance costs.

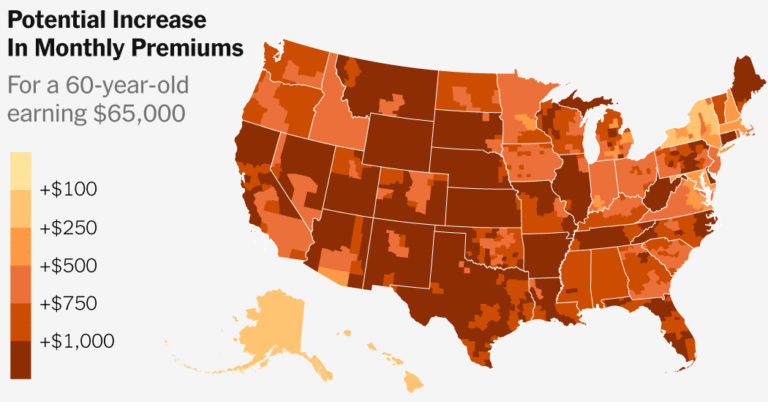

Location and Age Factors

For individuals earning approximately $65,000, premiums vary significantly based on geographic location and age, with older adults bearing the brunt of the increases. Those nearing retirement could face costs soaring from hundreds to over $1,000 monthly without the additional subsidies. Rural areas often report steeper premiums, making location a critical factor in determining insurance costs.

High Earners and Their Costs

Individuals earning higher incomes also see considerable insurance prices regardless of the subsidies in place. For many younger high-income earners, the additional assistance provided little benefit this year, as subsidies only take effect when insurance costs exceed 8.5% of one’s income, primarily in the most expensive markets. Older, higher-income individuals, however, have seen some savings under the subsidies but will face steeper costs without them next year.

Final Thoughts on Upcoming Price Changes

As the new insurance plans roll out, these changes in premiums will significantly affect families purchasing coverage, especially for those in lower-income brackets. For individuals and families looking to estimate their potential costs, various online calculators, such as those from KFF, provide valuable resources in navigating these shifts. Understanding the implications of subsidy changes is essential for securing affordable healthcare going forward.