Emerging Markets Update: Currencies, Stocks, and AI Investment

(Bloomberg) — The majority of emerging-market currencies fell as the dollar ended a four-day losing streak. Traders are navigating economic uncertainties resulting from the ongoing US government shutdown, even as stock markets demonstrated signs of growth.

Currencies Weaken Amid Economic Uncertainty

The MSCI Inc. index tracking developing-nation currencies closed Thursday with a minor dip of less than 0.1%. Among the weakest performers were high-yielding currencies such as Mexico’s peso, South Africa’s rand, and Brazil’s real, reflecting a broader trend in a basket of 23 exchange rates monitored by Bloomberg.

Labor Market Insights Amid Shutdown

This week brought some insights into the US labor market through job openings data and ADP payroll figures. However, weekly initial jobless claims were not published due to the government shutdown, and Friday’s anticipated nonfarm payrolls report is also likely to be delayed.

Market Sentiment on Risk Appetite

“The market appears hesitant to take on additional risks at this time,” remarked Ning Sun, a senior emerging-markets strategist at State Street Global Markets. “US data remains the key influence, particularly in how it blends inflation and growth.”

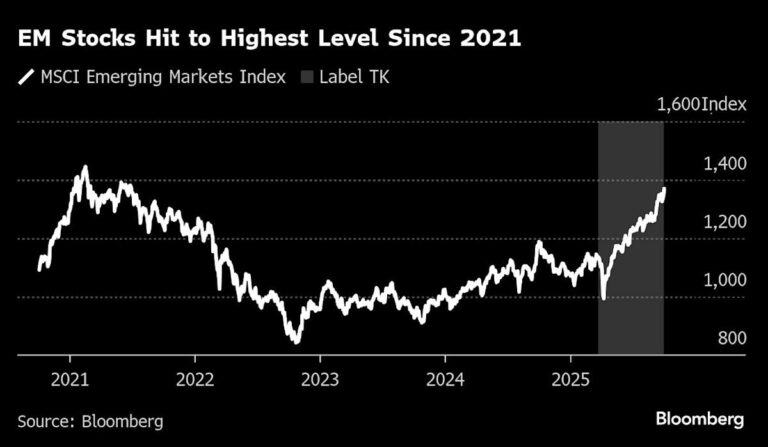

Stock Market Optimism Fueled by AI

Emerging-market stocks reached their highest level since mid-2021, driven by optimism surrounding artificial intelligence. The MSCI index for EM stocks gained 1.1%, bolstered particularly by technology stocks such as Taiwan Semiconductor Manufacturing Co. and Alibaba Group Holding Ltd., following a significant share sale by OpenAI.

OpenAI’s Rising Valuation

OpenAI’s valuation soared to $500 billion after current and former employees sold roughly $6.6 billion in stock, a significant jump from its prior value of $300 billion. The company is collaborating with South Korean chipmakers to support its Stargate project, further fueling enthusiasm in the AI sector.

Investor Sentiment Shifts Towards Technology

“Investors are increasingly drawn in by the themes of AI and technology,” noted Rajeev De Mello, a global macro portfolio manager at Gama Asset Management. “The Fed’s easing measures have also helped technology stocks, and as year-end approaches, more cautious investors are reconsidering their positions.”

Emerging Markets in Focus

Marc Bindschaedler from Vontobel Asset Management pointed out that China is just beginning its AI investment journey, indicating a revival of interest in emerging-market stocks after years of being overlooked. However, he cautioned that momentum-driven rallies could be susceptible to rapid pullbacks.

Current Trends in Credit Markets

In related financial news, Romania has issued new euro-denominated bonds, while Kenya plans to sell eurobonds aimed at repurchasing 2028 notes. Argentina’s dollar bonds saw a rise after reports surfaced about Economy Minister Luis Caputo and Central Bank President Santiago Bausili arriving in the US to discuss a swap line.

Market Strategy Recommendations

Citigroup strategists have advised taking profits from the recent rally of the South African rand. They indicated that while the rand has performed well amid a stronger domestic narrative, profit-taking is prudent given the short-term trade dynamics. Their long-term outlook for the currency, however, remains optimistic.