Foreign Investors Summit 2025: Emphasizing Stability for Bangladesh’s Growth

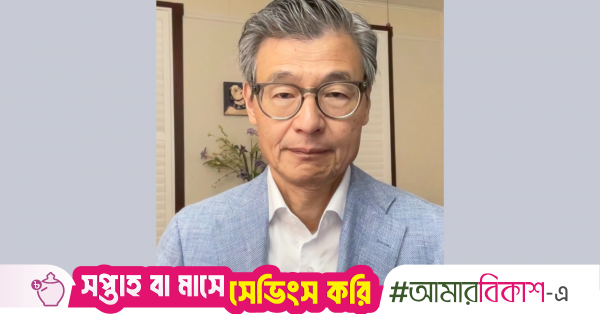

At the Foreign Investors Summit 2025 held in Dhaka, Takao Hirose, Managing Director of Contextual Investment LLC, delivered a vital message: both political stability and inclusivity are essential for attracting long-term foreign investment to Bangladesh.

A Call for Political Stability

Addressing an audience of policymakers, financiers, and corporate leaders at the Sheraton Dhaka on August 13, Hirose shared his insights following his arrival in the country to witness its political changes. He engaged with various local individuals, including hotel staff and taxi drivers, to gauge public sentiment regarding recent political shifts, discovering a mix of optimism tempered by caution.

Economic Growth and Microfinance

Hirose highlighted Bangladesh’s impressive economic growth, largely attributed to the pioneering efforts of microfinance organizations like BRAC and Grameen Bank. These institutions have empowered small enterprises—especially those led by women—laying a solid foundation for sectors such as ready-made garments.

The Dangers of Fast Money

Hirose was forthright about the nature of global investors, describing them as “fast money” that is both opportunistic and unpredictable. He cautioned that signs of political instability could drive foreign investors away, emphasizing the necessity of a stable environment to foster investor confidence. “Foreign investment can invigorate growth but can also become a disruptive force in times of instability,” he stated.

Inclusivity in Economic Growth

Hirose urged for inclusive market growth that allows widespread participation in wealth creation, referencing the US in the 1990s, which saw increased stock ownership among small investors. He underscored the importance of technology in democratizing investment, advocating for the development of stock trading applications to facilitate accessible investment options.

Learning from Sri Lanka

Ruchir Desai of Asia Frontier Investments Limited echoed the importance of stability, drawing parallels between Bangladesh and Sri Lanka. As foreign investor confidence in Bangladesh began to fluctuate, Desai observed lessons from Sri Lanka’s economic challenges, reinforcing the notion that without stability, even prosperous economies can stall.

Local Leaders’ Perspectives

Leaders such as Anisuzzaman Chowdhury emphasized Bangladesh’s unique resilience amid political changes, claiming the capital market has remained robust in the global context. Furthermore, he encouraged both domestic and foreign investors to seize current opportunities in Bangladesh’s capital market, aligning with the government’s vision for economic inclusivity and growth.

Conclusion: A Future Emerging

With positive indicators such as decreasing inflation and strengthened remittances, Bangladesh stands on a promising foundation. Local leaders call for an environment that prioritizes deregulation and opens up the economy, setting the stage for significant foreign investments. A coherent strategy centered on stability and inclusivity could propel Bangladesh toward realizing its economic potential in the coming years.