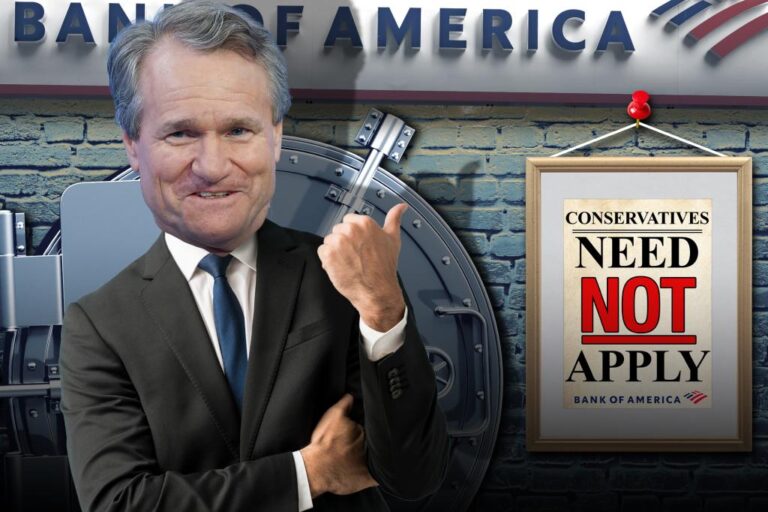

Bank of America Reverses Controversial Debanking Rule Affecting Conservative Groups

Bank of America (BofA) has officially eliminated a contentious policy that critics claimed led to the “debanking” of charities and businesses linked to conservative religious organizations. This significant move follows growing pressure from various stakeholders.

Backlash Against Banking Practices

BofA CEO Brian Moynihan, along with JPMorgan Chase’s CEO Jamie Dimon, faced criticism from former President Trump for denying banking services post-2021. Reports indicate that both banks succumbed to pressure from the Biden administration to sever ties with Trump following the events of January 6.

Regulatory Concerns and Political Influences

Both banks opted to distance themselves from Trump and MAGA-affiliated entities, citing a so-called “reputational risk clause” in federal regulations. This rule allowed financial institutions to refuse service based on perceived reputational threats, heavily influencing their decisions amid a politically charged climate.

Impact on Evangelical Organizations

Evangelical organizations have faced mounting challenges, with bank executives noting that certain policies allowed administrators to deny services based on religious viewpoints. This discriminatory practice threatened to silence groups opposing progressive cultural norms, including views on marriage.

Changing Landscape in Banking

In response to increasing scrutiny from conservative activists, numerous major banks, including JPMorgan, abandoned the “viewpoint” rule in 2022 due to its potential legal implications. However, BofA remained the sole holdout until June 2023, when it amended its Code of Conduct to explicitly forbid discrimination based on religious beliefs.

BofA’s New Stance and Future Commitment

A spokesperson emphasized that “religious viewpoints are not a factor” in any account closure decisions and reaffirmed BofA’s commitment to working with approximately 120,000 non-profits associated with religious organizations nationwide.

The Role of Activism in Banking Decisions

This policy shift aligns with an executive order issued by Trump aimed at banning debanking for ambiguous political reasons. Notably, economist Jerry Bowyer, CEO of Bowyer Research, has played an instrumental role in addressing the issue of religious debanking in major banks like BofA and JPMorgan.

Conclusion: A Step Toward Inclusivity

Bowyer’s efforts prompted discussions about the need for fair banking practices, culminating in policy changes at BofA. His encounters with the bank regarding discriminatory practices reveal the importance of grassroots activism in influencing corporate policies. Bowyer remarked, “Better late than never,” acknowledging the change as a significant win for advocacy and inclusivity in the banking industry.