An Unusual Spike in the Dollar Rate Pushes Inflation to Nearly 10.49%

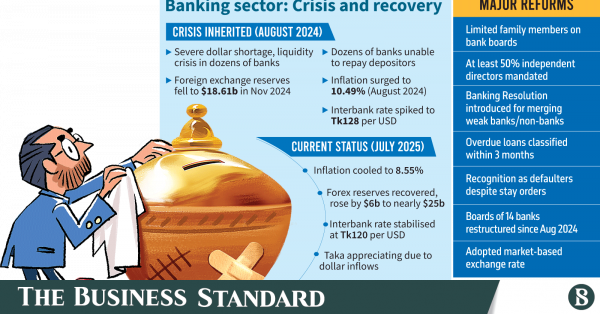

In August of last year, Bangladesh experienced a significant inflation rate of approximately 10.49% driven primarily by an unusual spike in the dollar exchange rate. This rise in inflation was attributed to a severe dollar shortage that created liquidity crises in many banks, resulting from ongoing economic instability in the country.

Measures Taken to Address Economic Challenges

During the governance transition following the July uprising, the interim administration faced a daunting task. With foreign exchange reserves dwindling and numerous banks incapable of fulfilling deposit demands, Bangladesh Bank implemented critical reforms to stabilize the economic situation.

Improvements in Dollar Supply and Inflation Rates

Over the past year, these reforms have positively impacted the economy. The interbank dollar exchange rate, which peaked at Tk128, has now settled around Tk120 due to improved dollar supply. Consequently, inflation has decreased to 8.55% by July, indicating steady progress toward economic recovery.

Banking Sector Reforms and Governance

Key reforms in the banking sector focus on governance, including amendments to the Bank Company Act to limit family control over boards and enhance the independence of Bangladesh Bank. These reforms aim to ensure robust financial health and restore public trust in banks, which are crucial for economic growth.

Focus on Default Loans and Asset Recovery

Recent data revealed alarming levels of default loans, estimated to exceed 30%. Governor Ahsan H Mansur highlighted the urgent need for transparency and rigorous loan classification. Efforts are underway to recover funds from banks identified as having non-performing loans ranging from 70% to 95%, some of which may require temporary nationalization for depositor protection.

Market-Based Exchange Rate and Its Effects

On May 14, 2025, the central bank shifted to a market-based exchange rate regime, which has helped stabilize the forex market and encourage remittances. Monthly remittances saw a remarkable rise, reaching nearly $3 billion, fostering a healthier economic environment and enhancing foreign reserves.

Challenges in Asset Recovery and Future Prospects

Despite ongoing efforts, progress in asset recovery has been slow, with no significant cases presented to foreign courts. The governor acknowledged challenges due to coordination issues and highlighted the imperative to dismantle criminal networks linked to laundered billions. The future may hold opportunities for recovery through a structured legal approach, but this requires time and persistent effort.

Conclusion: Optimism for Economic Recovery

As inflation targets evolve and the banking sector continues to reform, there is a cautious optimism surrounding the economic recovery in Bangladesh. With the right policies and governance structures in place, the country can aim for a more stable financial future, ultimately benefiting its citizens and the broader economy.