Understanding Luxury Authentication in the Resale Market

Dressed in a crisp white lab coat, Mélissa B. carefully dons thin cotton gloves before placing a Zanzibar blue Hermès Birkin bag on her desk. This iconic piece, valued at $18,000, is surrounded by its signature orange box, a protective dust cover, and essential documentation. Mélissa steps back, scrutinizing the purse for any signs of imperfection or irregularities. Her meticulous examination reveals the complex world of luxury resale and the critical role of authentication in preserving brand integrity.

The Authentication Process

At Vestiaire Collective’s authentication center in Tourcoing, France, Mélissa and her colleagues are tasked with determining the authenticity of luxury items. They inspect everything from the stitching to the hardware, ensuring consistency and quality. Mélissa meticulously checks for the presence of four palladium feet on the bottom of the bag, confirming they’re hammered and made from the same material as the bag’s hardware. The final check involves a close inspection of the zipper, guaranteeing it’s a unique Hermès construction. With each assessment, the threat of counterfeits grows more pronounced.

Rising Sales in the Secondhand Luxury Market

The secondhand luxury market is experiencing significant growth, projected to exceed $50 billion in 2024, representing a 7% increase from previous years, according to Bain & Co. As luxury resale sales soar, companies like Vestiaire Collective and the RealReal are enhancing their authentication processes. Vestiaire’s revenue rose 20% last year, and their commitment to combatting counterfeit goods has become increasingly vital. With legal tariffs driving up prices on new luxury items, the appetite for secondhand goods is only expected to intensify.

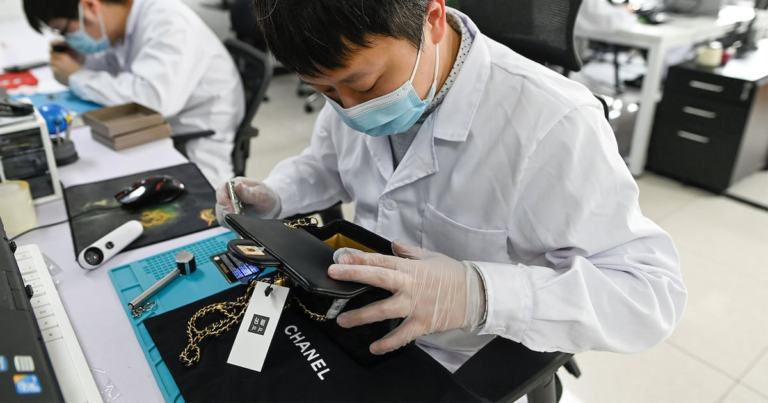

The Challenge of Superfakes

Counterfeit luxury goods are no longer limited to low-quality imitations. Today’s “superfakes” are alarmingly close to the real deal, making it more challenging for experts like Mélissa to identify them. Vestiaire Collective reports that over half of the items they reject are suspected counterfeits, underscoring the need for vigilant authentication processes. This dynamic has shifted the focus of luxury resale companies, forcing them to stay ahead of increasingly sophisticated counterfeit operations.

Legal and Industry Trends

Despite initial resistance, luxury brands are gradually accepting the resale market. As many of their most sought-after items perform strongly in the secondhand arena, partnerships with resale platforms are becoming more common. For instance, several luxury houses have begun collaborating with Vestiaire, acknowledging that preowned luxury is a lasting trend. However, the absence of a global authentication standard poses challenges, compelling resale companies to emphasize their authentication methods over claims of authenticity.

Advancements in Technology and Authentication

Vestiaire Collective’s Tourcoing authentication academy prepares its team with extensive training in identifying fakes. As technology advances, so does the reliance on artificial intelligence and emerging authentication methods. Initiatives like the Aura Blockchain Consortium aim to standardize the authentication process through digital IDs, significantly aiding in brand verification. Yet, questions remain regarding consumer perception and value in an increasingly blurred line between authentic and counterfeit luxury goods.

Changing Consumer Behavior

Recent trends indicate a shift in consumer attitudes toward counterfeit products. With prices for luxury goods soaring by an average of 54% since late 2019, many U.S. adults report intentionally purchasing counterfeit items. The rise of “dupe culture” reflects a growing acceptance of fakes, and the once-stigmatized imitation goods are now celebrated. As luxury brands struggle to maintain their images of exclusivity, they face the challenge of adapting to a consumer base that prioritizes accessibility.

In conclusion, while the luxury market grapples with authenticity and counterfeiting issues, it must also navigate evolving consumer expectations. As the distinctions between real and fake blur, brands that fail to adapt risk alienating a generation that values accessibility just as much as exclusivity.

By Lindsey Tramuta