Current Trends in Crude Oil Trading

Overview of Recent Crude Oil Performance

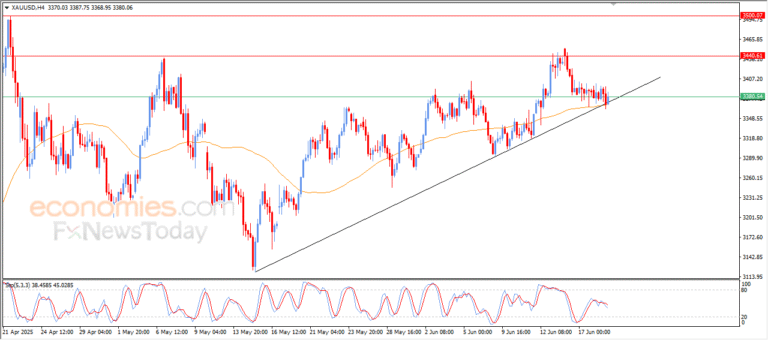

Crude oil has experienced fluctuating trading patterns in its recent intraday sessions. Overall, the short-term outlook remains largely bullish, as evidenced by price movements within both main and minor bias lines. The continued trading above the EMA50 (Exponential Moving Average) indicates solid technical support for the commodity, suggesting a potential for stability in prices moving forward.

Understanding Short-Term Bullish Trends

The bullish trend in crude oil reflects a sustained demand in the market, driven by various economic factors. As traders keep a close watch on price movements, the presence of established bias lines provides crucial insights into potential future trends. The ability to maintain prices above key indicators like the EMA50 reinforces the notion of an ongoing positive market sentiment.

Identifying Weakness in Bullish Momentum

Despite the prevailing bullish trend, there are signs of weakening momentum. Recent negative signals observed on the Relative Strength Index (RSI) suggest that crude oil has reached overbought levels. This overextension may introduce volatility in trading as the market seeks to adjust and stabilize.

The Role of RSI in Market Analysis

The RSI is a vital tool for traders in assessing market conditions. When the RSI indicates overbought levels, it serves as a warning signal, suggesting that a price correction may be imminent. This information is crucial for traders looking to make informed decisions regarding their investments in crude oil.

Price Stabilization Efforts

The recent fluctuations in crude oil prices may prompt a period of consolidation as the commodity seeks to offload its overbought condition. By stabilizing, crude oil can gather momentum and potentially resume its upward trajectory. Technical indicators provide essential guidance during this phase, supporting traders in navigating the changing landscape.

Market Outlook and Future Predictions

Looking ahead, market participants remain cautiously optimistic about crude oil’s future trajectory. The balance between bullish momentum and overbought signals will play a critical role in shaping price movements. As traders continue to analyze data and trends, the ability to identify support levels will be paramount in forecasting subsequent market behavior.

Conclusion: Navigating the Crude Oil Market

In summary, the crude oil market showcases a complex interplay of bullish trends and corrective signals. Being aware of these dynamics is essential for traders aiming to succeed in this volatile environment. Continued vigilance and analysis of technical indicators will be vital as crude oil strives for stability and potential growth in the coming weeks.