Bitcoin: Bridging the Gap Between Skepticism and Acceptance

Introduction

Bitcoin, once predominantly viewed as a means for conducting illicit transactions on the dark web, has transitioned into a more acceptable asset in the eyes of institutions. However, despite its growing mainstream presence, skepticism continues to linger among some influential figures in finance.

Institutional Adoption

From Wall Street giants like BlackRock to U.S. governmental entities, Bitcoin has established a firm foothold in traditional finance. The acceptance of Bitcoin has evolved to the point where it is even possible to purchase everyday items, like burgers, using this leading cryptocurrency.

The Persistence of Skepticism

Despite its rising profile, many individuals, including legendary investors such as Warren Buffett and Jamie Dimon, remain critical of Bitcoin. Their perspective raises an important question: why do some people continue to struggle with understanding the value and functionality of Bitcoin?

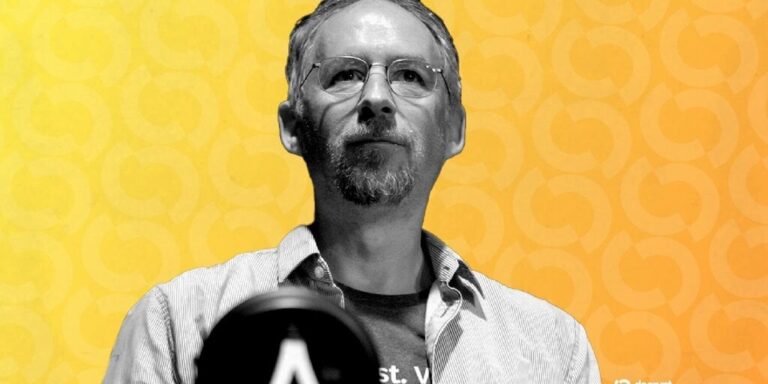

Expert Insights from Adam Back

In a recent discussion with Decrypt, Adam Back, a prominent early Bitcoin adopter and CEO of Blockstream, noted that even those proficient in technology often find Bitcoin challenging to grasp. He expressed bewilderment over the ongoing skepticism surrounding the cryptocurrency, especially among cypherpunks who were once at the forefront of digital innovation.

Understanding Digital Assets

Back emphasized that the intangible nature of Bitcoin contributes to public skepticism. Many individuals question how something that lacks a physical form can hold value, despite the cryptocurrency being underpinned by tangible resources like energy and mining equipment. This challenge in perception significantly impacts Bitcoin’s acceptance as a mainstream asset.

The Rationale Behind Bitcoin’s Scarcity

Bitcoin operates as a digital payments system, with a maximum supply of 21 million coins made possible through its secure cryptographic framework. Advocates argue that this limited supply enables Bitcoin to serve as a hedge against inflation, a notion gaining traction in today’s economy.

Addressing Economic Inequality

Back pointed out that individuals who thrive within the current financial system may find it difficult to appreciate Bitcoin’s beneficial aspects. If their economic situation remains stable, they may not feel the urgency for an alternative like Bitcoin, which was created as a response to financial instability during the 2008 recession.

Conclusion

As Bitcoin continues to evolve, its advocacy faces both traditional finance skepticism and growing institutional interest. Understanding its value and addressing public skepticism remain pivotal challenges in Bitcoin’s journey toward broader acceptance. While the path may be fraught with doubt, the potential of this digital currency offers a fascinating frontier in modern finance.