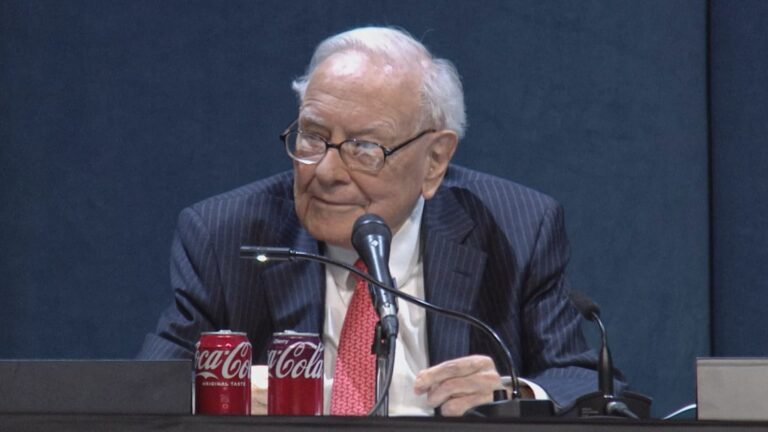

Warren Buffett on Recent Market Volatility

OMAHA, Nebraska — At the annual meeting of Berkshire Hathaway, Warren Buffett provided a reassuring perspective on the recent fluctuations in the stock market that have left many investors unsettled.

Market Movements and Investor Reactions

Buffett remarked, “What has happened in the last 30, 45 days … is really nothing.” His comments highlighted a sense of calmness amidst the recent market turbulence, encouraging investors to maintain a long-term perspective.

Historical Context of Berkshire Hathaway’s Performance

The CEO of Berkshire Hathaway reminded attendees that the company’s stock has experienced significant declines in the past, with three instances over the last sixty years where it dropped by 50%. He emphasized that, during those times, there were no underlying problems with the company, suggesting that current market conditions should not be alarmingly characterized.

Not a Bear Market

Buffett dismissed the label of a “dramatic bear market,” stating, “This has not been a dramatic bear market or anything of the sort.” His analysis encourages investors to differentiate between market corrections and more serious downturns.

Investor Sentiment and Future Outlook

Buffett’s insights came as the financial community closely monitored stock market movements influenced by geopolitical events, including President Donald Trump’s tariff policies. Meanwhile, the S&P 500 achieved its longest winning streak since 2004, recovering losses once seen at the onset of these trade tensions.

Reminders from Buffett’s Experience

The 94-year-old investor illustrated his point with historical anecdotes, recalling that the Dow Jones Industrial Average was at 240 on his birthday in 1930 and fell to as low as 41. Despite these dramatic changes, it has risen significantly over decades. He emphasized the importance of an adaptable investment philosophy.

Conclusion: The Importance of Emotional Discipline in Investing

Buffett advised investors, “If it makes a difference to you whether your stocks are down 15% or not, you need to get a somewhat different investment philosophy.” He stressed the necessity of emotional discipline in investing, urging individuals to leave emotions aside when making financial decisions.