The Rise and Challenges of CLO ETFs in Today’s Market

In recent months, it’s not just stocks or interest rates capturing market attention; the corporate debt markets, particularly collateralized loan obligations (CLOs), have also seen a surge in interest. One notable area to monitor is the increasing popularity of exchange-traded funds (ETFs) focused on investing in CLOs.

Explosive Growth of CLO ETFs

CLO ETFs have witnessed remarkable growth over the past couple of years, with total assets skyrocketing to $30 billion by the end of 2022—a staggering 13-fold increase from the $2.3 billion recorded at the same time. A significant portion of this surge can be attributed to the Janus Henderson JAAA ETF, which specifically invests in high-quality, triple-A rated CLO tranches.

Recent Market Pullbacks

Despite their popularity, the market for CLO ETFs is starting to show signs of distress. Recent data from Morningstar reveals that investors withdrew a record $1.8 billion from these funds within a single week, marking a notable shift in investor sentiment. As noted by Todd Rosenbluth from TMX VettaFi, this trend is part of a broader retreat from assets that carry credit risks:

“We have seen anything that is not Treasuries in fixed income fall out of favor with investors. Investors are just hunkering down.”

The Mechanics of CLOs

Understanding CLOs is crucial to grasping their popularity. These instruments are formed from floating-rate corporate loans, often issued to companies with lower credit ratings, such as BB or B grades. These loans are grouped into pools, which are then securitized, allowing managers to create tranches with varying risk levels. This process converts many of these lower-rated loans into appealing triple-A securities for risk-averse investors.

Market Risks and Investor Behavior

While no AAA-rated CLO has defaulted since their inception in 1997, the looming concerns over credit risks are shaking investor confidence. With expectations of Federal Reserve rate cuts on the horizon, the appeal of floating-rate debt is diminishing. Matthew Bartolini from State Street Global Advisors elaborates on this vulnerability:

“They are credit instruments. While they may rank high in the capital structure, there’s still a credit component, and we are seeing a sell-off in credit assets.”

Impact on Private Equity and Credit Markets

The extensive sell-off of CLOs by ETFs has compounded the challenges faced by private equity firms, making it increasingly difficult to find buyers for their debt. Notably, recent bond sales to finance buyouts involving companies like Apollo have completely stalled.

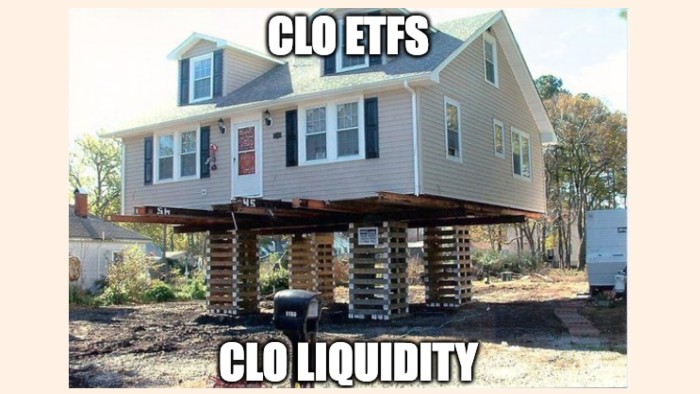

Evaluating CLO ETF Performance in Volatile Markets

One of the pressing questions is how these CLO ETFs would perform in a more turbulent environment. Unlike junk bond ETFs, which trade actively in the public market, CLO tranches are essentially structured as private credit, complicating cash redemptions. Some analysts believe that this selling frenzy is a result of stale pricing in the underlying securities, a phenomenon reminiscent of the early days of the Covid-19 pandemic. As Rosenbluth cautions:

“ETFs provide real-time price transparency, which can lead to discounts during market sell-offs.”

Conclusion: Future Outlook for CLO ETFs

While recent trends indicate a pullback in investor interest in CLO ETFs, their long-term viability in a changing economic landscape remains to be seen. Observing their resilience in subsequent market turmoil will be key for potential investors. As always, keeping a close eye on credit market dynamics is essential for informed decision-making.