Bullish Bitcoin Options Strategies Gain Traction Amid Market Recovery

Bullish options strategies for Bitcoin (BTC) are experiencing a resurgence, stabilizing a key sentiment indicator that previously reflected panic in the market. Following a fall below $75,000 last week, Bitcoin has rebounded to over $84,000, signaling a shift in trader sentiment and market dynamics.

This price recovery coincides with recent developments in the bond market, where increasing turbulence seems to have pressured President Donald Trump to reconsider his stance on tariffs. Days after imposing broad import levies on various nations, including China, the administration announced exemptions for essential tech products, such as smartphones, from the proposed 125% tariffs.

However, Trump’s administration later contradicted these updates, leading to confusion regarding the tariff situation. Despite this volatility, the bullish momentum for Bitcoin remained strong as traders began to pursue upside through call options on Deribit, a leading exchange for cryptocurrency derivatives. A call option allows an investor the right, but not the obligation, to purchase the underlying asset at a set price before a stipulated date, implying a bullish outlook.

Market analysis by Deribit revealed a notable transition in trading strategies: “The tariff-induced climate reversal shifted the market’s narrative from aggression to capitulation, prompting a significant bounce back. Traders offloaded their protective puts at the $75K-$78K strikes and shifted their focus to $85K-$100K calls as Bitcoin surged from $75K to $85K,” the report stated.

This pivot towards call options has helped normalize the options skew. Data from Amberdata suggests that the skew, which gauges the implied volatility (demand) for calls compared to puts, has rebounded significantly, indicating a decline in market panic and an increase in bullish sentiment. The 30-, 60-, and 90-day skews now hover just above zero, a stark contrast to the deeply negative levels observed a week prior.

Market Focus Shifts to $100K Call Options

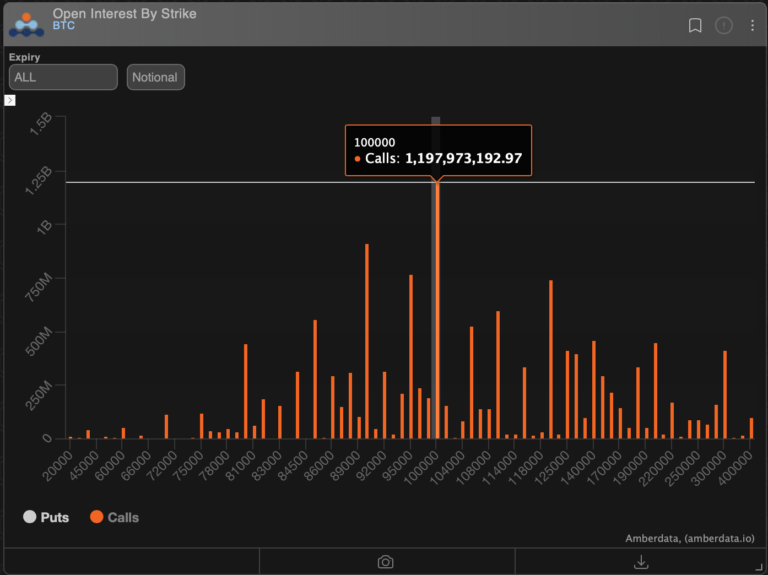

Amid these developments, the most popular bet among traders appears to be the $100K call option. Current open interest distribution indicates a surge in the appetite for $100K calls on Deribit, which is a primary venue for global options trading, accounting for over 75% of the market activity. At present, the cumulative notional open interest for the $100K call is nearly $1.2 billion, representing a robust bullish outlook among options traders.

Earlier in the year, interest in $100K and $120K calls was prominent before a market downturn prompted a shift towards the $80K put options last month. Analyzing the concentration of open interest, calls in the range of $95,000 to $120,000 are gaining traction. Meanwhile, the $70K put option stands robustly as the second-most favored strategy, with an open interest of $982 million, showcasing a balanced strategy among market participants.

As Bitcoin continues to show volatility, the dynamics of the options market reflect the evolving sentiments of traders. The normalization of the options skew, alongside the increasing interest in bullish strategies like $100K calls, underscores a collective anticipation of favorable price movements in the near future. This trend of optimism could be pivotal in shaping the outlook for Bitcoin as traders navigate the complexities of the current market landscape.